Meaning of Memorandum of Association

Memorandum of Association (MOA) is a charter document of the company which is prepared during the formation of a company. The Memorandum of Association is the most important document of the company as the company’s main object is mentioned under this document. Every company is bound to perform its functions keeping in mind the objective mentioned in the memorandum.

A company cannot perform any function beyond its object, and whenever any company or individual collaborate or merge with a company, the memorandum is the first and foremost thing they read before making any contract with the particular company.

The company’s memorandum can be altered through an established procedure, and every clause of the memorandum is altered through a different procedure.

Let us learn more in this note on the Memorandum of Association.

Memorandum of Association in Company Law

Memorandum of Association is defined under section 2(56) of the Companies Act, 2013, which states “memorandum” as a memorandum of association of the company that is originally formed or altered from time to time. It is a charter document of the company and mentions the terms of association with the company along with the name, object, and scope of the company.

Purpose of Memorandum of Association

There are a few reasons for which any company needs to form a Memorandum of Association. They are:

1. The shareholders who are investing their money in the company have the right to know the purpose for which they are investing their money and the company’s field of operations. Therefore, this purpose is mentioned in the memorandum.

2. Any person, be it a vendor, partner, employee, etc., must know the corporate objects of the company and whether his contract is according to the objects of the company.

Must Read: What Is Articles of Association of a Company

Clauses of Memorandum of Association

Contents which are mentioned in the memorandum of a company are:

Let us learn more about these five clauses of the Memorandum of Association.

1. Name Clause.

A company can have any name of its choice, keeping in mind certain conditions. A company must include “Private Limited” at the end if the company is a private company. And in the case of a public company, it must include the word “Limited” at the end.

The company’s name mentioned in the memorandum must not contain the words which are:-

(i) Identical or resemble.

The company’s name should not be identical or must not have a resemblance with the name of any other existing company registered under the companies act.

(ii) Already in use.

The name of the company shall not be something that is already in use by any other company.

(iii) Undesirable names.

A company shall not include any name that creates an impression that the company is associated with the central government, any state government, local bodies, etc., or with any such body created by the central or state government. A company can include words that resemble its existence with any government entity only after their prior approval.

Any company is not allowed to use the word ‘National‘ in its title unless it is a government company or the government has any stake or shareholding in it. Similarly, the word ‘company‘ or ‘exchange‘ can be used with the title of any company or entity only after obtaining the Non-Objection Certificate from SEBI (Securities and Exchange Board of India).

Reservation of company name.

Applying for Name: A person may apply for registration of a new name or change of name in the format as may be prescribed by the registrar with the prescribed form and manner, along with the fees.

Reserving the name: After checking the documents along with the application form, the registrar reserves the name for sixty days from the date of application.

Cancelling name: If, after the reservation of name, it is known that the company has reserved its name showing incorrect or wrong documents, then:

- The reserved name shall be cancelled if the company is not yet incorporated, and the person will be held liable for the penalty, which may extend to even one lakh rupees.

- If the company is incorporated, then the registrar may give the company an option of being heard and then either direct the company to change its name within 3 months after passing an ordinary resolution or take necessary action for cancelling the name of the company from the register of companies or make a petition for winding up of the company. The government directed that the registrar should take proper care while reserving the name of any company or LLP and make sure that the names are not similar to any other body or entity.

2. Domicile Clause.

This clause mentions the name of the state where the company is incorporated. The whole address, city, etc., are never mentioned in the domicile clause; only the state in which the company operates is mentioned.

3. Object Clause.

It mentions the object or the purpose for the company is incorporated along with any other related object that can take place in the future. The company can never work beyond the object stated in its memorandum.

4. Subscription Clause.

Memorandum and articles of the company shall be duly signed by all the subscribers in such a manner as may be prescribed in Rule 13 of the Companies (Incorporation) Rule, 2014.

5. Liability Clause.

Under this clause, a company has to mention whether the liability of its members is limited by shares or guarantee or the liability is unlimited.

Limited by Shares: A member will be liable only for the number of shares purchased by him in the company.

Limited by Guarantee: The person has to guarantee a certain amount he will be supposed to pay if a company suffers losses and is winding up.

Unlimited Liability: In such cases, the company members are liable unlimitedly, even to the extent of their personal property, if a company suffers losses.

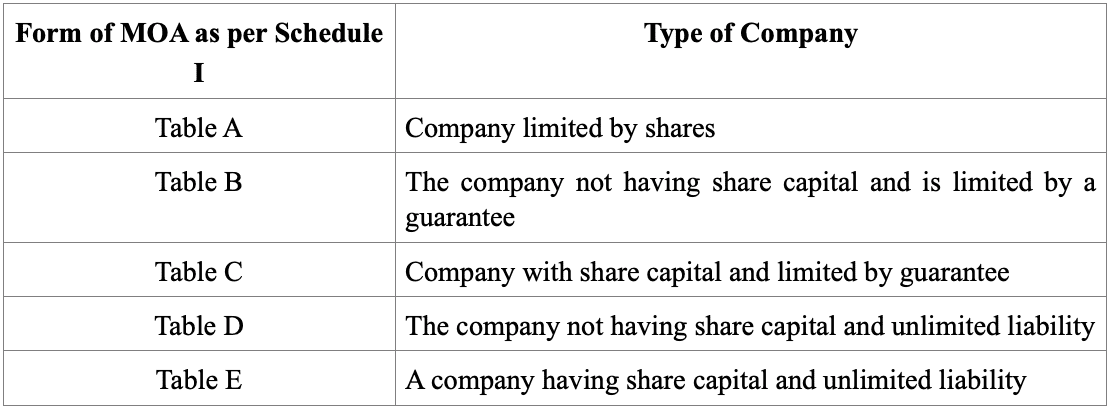

Form of Memorandum of Association

According to section 4 of the Companies Act, 2013, companies will be prescribed in the forms given under the tables according to different types of companies.

On the left, we have Form of MOA as per Schedule I, and on the right, we have the Type of Company.

Table A: Company limited by shares.

Table B: The company not having share capital and is limited by a guarantee.

Table C: Company with share capital and limited by guarantee.

Table D: The company not having share capital and unlimited liability.

Table E: A company having share capital and unlimited liability.

Here is the above information in table form.

Read Next:

1. Types of Prospectus Under Companies Act, 2013

2. Conversion of a Company Under the Companies Act

3. What Is Annual General Meeting (AGM) – Companies Act, 2013

- 13 Characteristics of a Company Under the Companies Act - 5th March 2024

- Lee vs Lee’s Air Farming Ltd – Case Explained - 5th March 2024

- Relevant Facts Under the Indian Evidence Act - 14th January 2024